how to pay taxes on betterment

Usually there is no penalty for an early payoff of a betterment loan. Box 9711 Boston MA 02114 You have up.

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Otherwise a homeowner pays off the betterment loan over time as an additional line item on their property.

. As an added bonus it can help you avoid paying income tax on Social Security benefits in retirement. With taxable investment accounts you generally owe taxes each year on the dividends and other distributions paid to you that year. Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as rollovers in their retirement accounts on the.

2 days agoFor example if youre a teacher and pay union dues of 20 from each semi-monthly paycheck be sure to use 40 when adding up your deductions. For individuals only. Your heirs will pay taxes on withdrawals from.

You may also owe taxes when you sell. The final step is to take your. You will receive one by Feb.

The betterment levy or special assessment as it is known in the United States is a compulsory charge imposed by a government on the owners of a selected group of properties to defray in. View the amount you owe your payment plan details payment history and any scheduled or pending payments. Only dividends and realized gains will have tax due.

Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. You can pay your taxes online or by phone on the IRS own system. You can mail payments by check or money order made payable to the City of Boston.

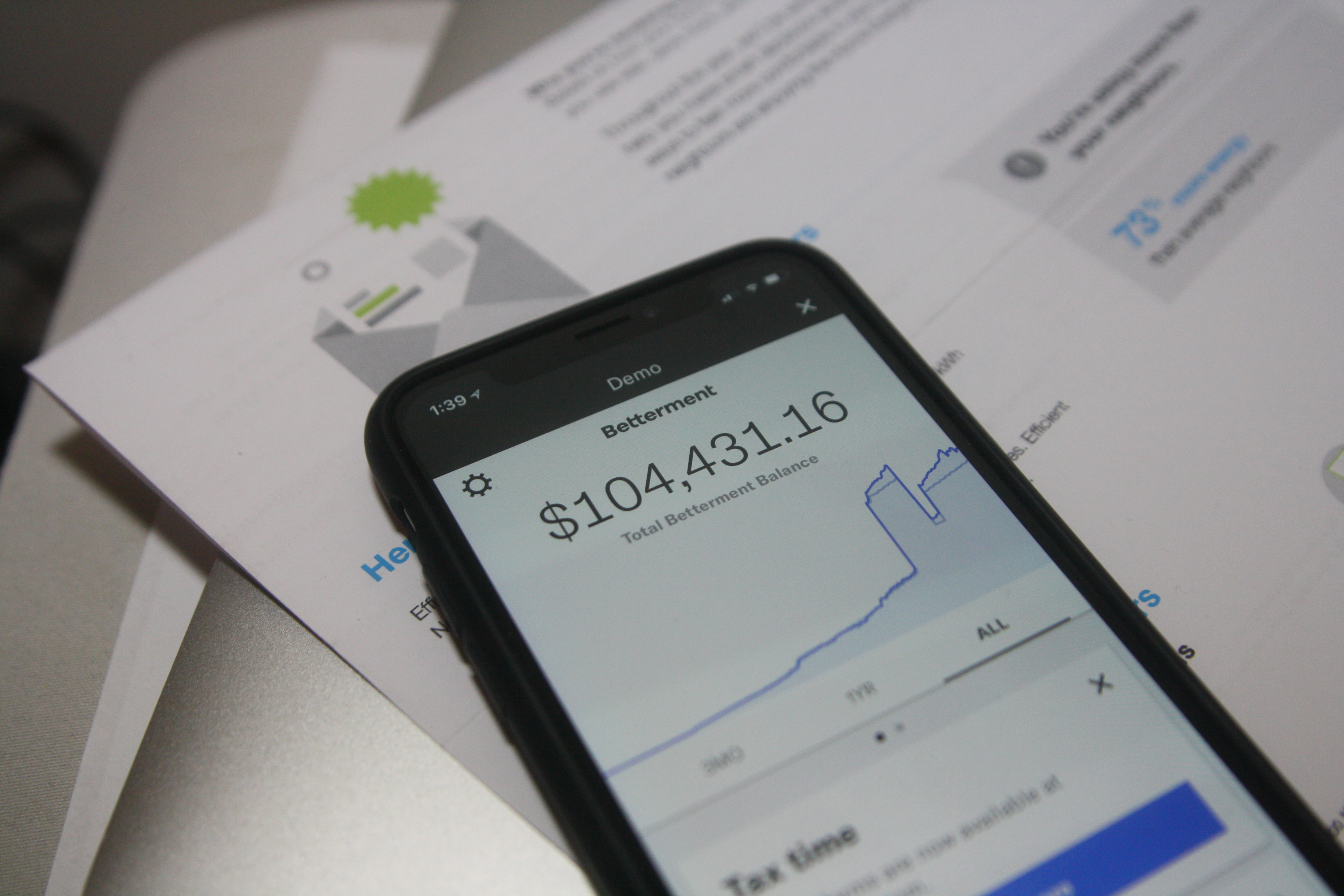

Betterment will send you. You pay yourself 60000 a year as a salary and pay the 153 self-employment tax of. 15 2022 if you had a Betterment taxable account and.

Make a same day payment from your bank. The 1099-DIV reflects dividend payments received and capital gains distributions from stocks you own. So how do you pay 0 taxes when you make six figures.

Pay directly from a checking or savings account for free. City of Boston Office of the Collector-Treasurer PO. Special Property Tax A.

Credit or debit cards. While you cannot deduct betterment taxes from your income when you file your federal income. Pay your taxes by debit or.

Pay your taxes by debit or credit card online by phone or with a mobile device.

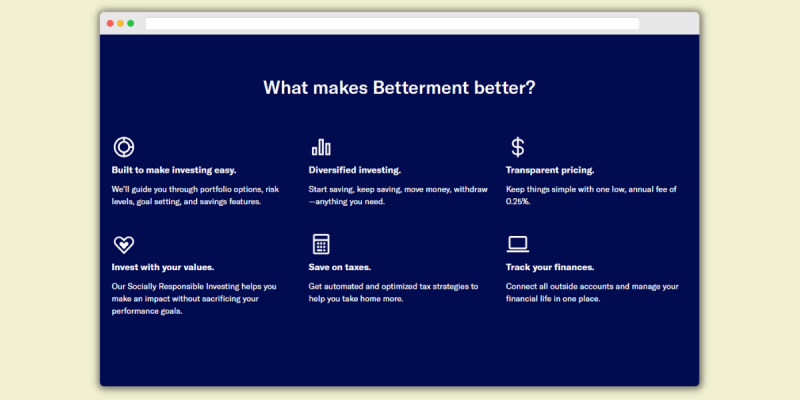

Betterment Review 2022 A Robo Advisor Worth Checking Out

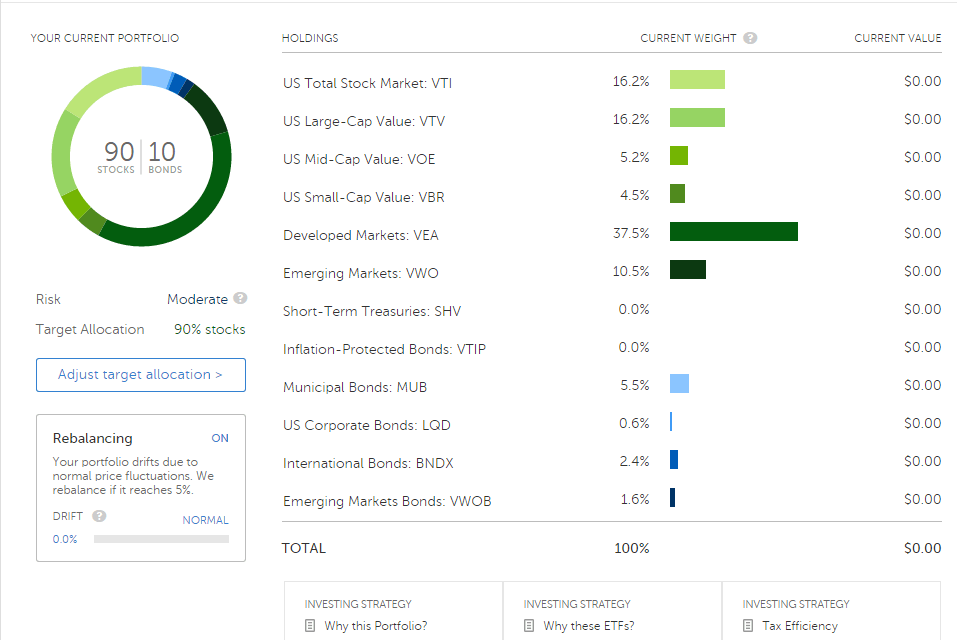

How Our Tax Coordination Feature Can Boost Your Returns

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Betterment Review 2022 Is This The Best Robo Advisor

Tax Impact Using Our Cost Basis Accounting Method

Betterment Review Safe Robo Advisor For Beginners

Better Investing With Betterment

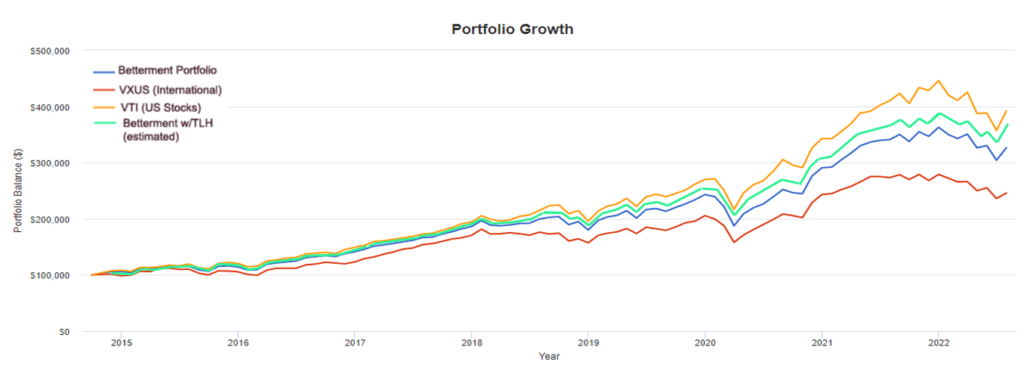

Tax Loss Harvesting Is Killing Your Nest Egg The Wealthy Accountant

Betterment Resources Original Content By Financial Experts

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Are Betterment Returns Higher After Taxes Https Investormint Com Investing Betterment Returns Higher After Money Affirmations How To Get Money Money Goals

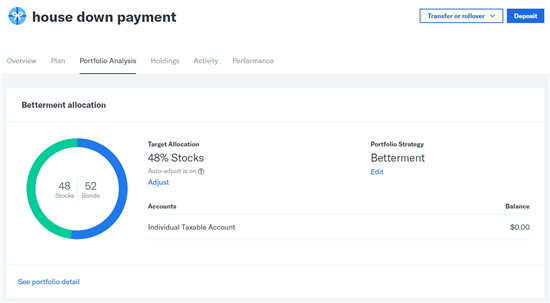

The Betterment Experiment Results Mr Money Mustache

Betterment Review Smartasset Com

Four Ways Betterment Can Help Limit The Tax Impact Of Your Investments

:max_bytes(150000):strip_icc()/GraphfromDanEganBetterment-255c6f94cd1a461fa05b376d80b50c3a.png)

How Betterment S Customers Are Behaving Amid The Volatility

Betterment Investing Robo Advisor 2022 Review Should You Use It Mybanktracker

Betterment Review 2022 A Robo Advisor Worth Checking Out

Betterment Review What I Use To Invest Millennial Money With Katie